Authors: Ousseni Illy and Seydou Ouedraogo

Summary

The West African Economic and Monetary Union (WAEMU) adopted Basel II and III standards simultaneously in 2016 and began implementation in 2018 with a transitional period of one and a half years. Given the weak development of the financial sector in the Union and its poor connectedness to the international financial system, this reform was unexpected. The adoption of Basel standards has been championed by the Central Bank of West African States (BCEAO). National governments and domestically oriented banks have not play an active role, complicating the implementation and enforcement of the new regulations. The Central Bank is embedded in regulatory peer networks, under the influence of the IMF, and insulated from domestic political pressure due to its supranational position. This makes WAEMU an example of IFI-driven convergence, with an internationally connected regulator advocating implementation under pressure from IFIs.

Political economy background

Seven of the eight WAEMU countries are classified as low income, while Côte d’Ivoire is lower-middle income. Member economies are dominated by a few export crops and natural resources, gold, oil, uranium, phosphate and bauxite. The financial sector in the WAEMU countries is significantly underdeveloped, with banks dominating the financial sector and an embryonic regional stock market. As in other regions of Africa, the rise of pan-African banks is one of the most important developments in the WAEMU financial sector in the last decade. Pan-African banks took the lead in market share from European and American competitors in 2006, growing to about 60% of total assets in the region.

| GDP per capita (current USD) | 756 |

|---|---|

| Bank assets (current USD) | 3.25bn |

| Bank assets (% of GDP) | 29.915 |

| Stock market capitalisation (% of GDP) | 39.34 |

| Credit allocation to private sector (% of GDP) | 24.05 |

| Credit allocation to government (% of GDP) | 5.62 |

| Polity IV score (2017) | 5 |

Note: All data is from 2016 unless otherwise stated

Source: FSI Database, IMF (2018); GDI Database, World Bank (2017); Polity IV (2014)

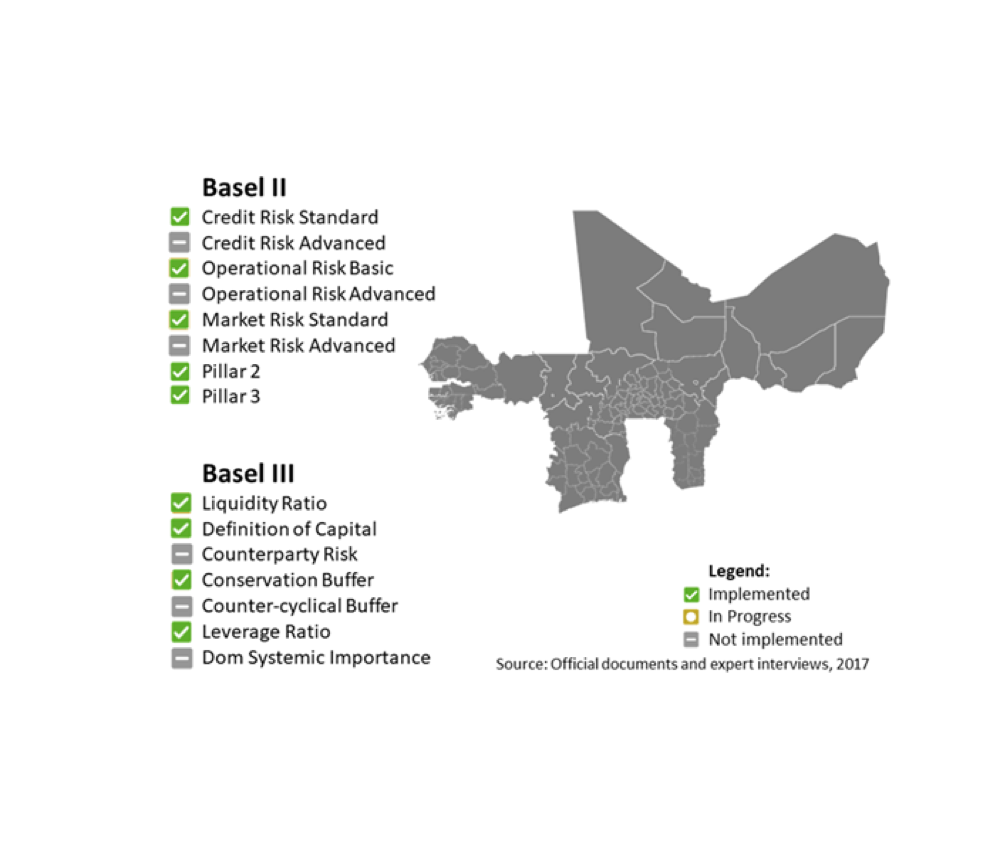

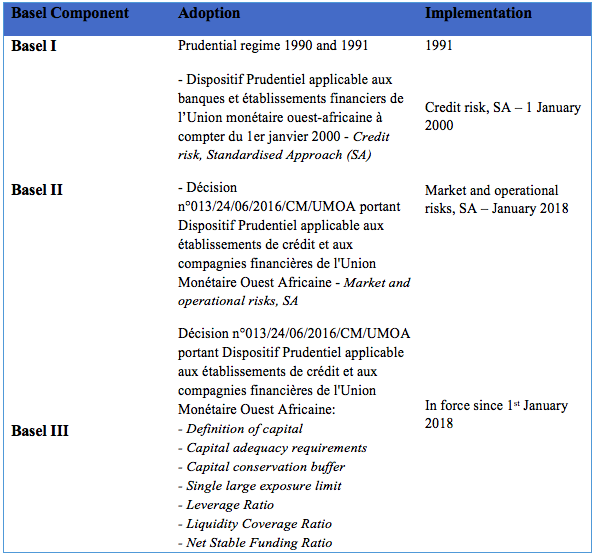

Basel implementation to date

International banking standards were introduced in the WAEMU for the first time in 1991, following the financial crisis of the 1980s. Initial moves towards Basel II adoption date to 2004 but the process did not result in concrete reforms until the agreement on Basel III was reached by the Basel Committee in 2010, with the result that the BCEAO decided to adopt Basel II and III concurrently. Implementation started in 2013, with technical assistance coming from the IMF, and was completed by 2016, with new regulations slated to take effect in 2018. Implementation and compliance with regulations – the prudential regime in particular – have always been a concern in the WAEMU. An IMF report from 2017 asserted that the prevailing rules – despite being less strict than those that would take effect in 2018 – were not being effectively enforced.

There is no public record of an assessment study of WAEMU’s regulatory and supervisory framework in accordance with the Basel Core Principles.

Politics of Basel implementation

The BCEAO is the dominant player at the domestic level and is internationally oriented. Under the influence of the IMF, it played a decisive role particularly in the adoption of Basel I in the early 1990s and the revent adoption of Basel II and III. The other actors (national governments and banks) do not show strong preferences in support of or opposition to Basel standards. The banks, without forming a homogeneous group with respect to their preferences for regulation, have various reservations but have not coordinated resistance to the adoption of Basel II and III. Governments and political parties seem to be the least concerned and essentially passive by-standers.

The Central Bank is internationally oriented. Its executives and staff have received extensive training at the IMF and with the involvement of French experts. The IMF has pressured WAEMU to adopt Basel II and III standards, and IMF technical assistance has overseen impact studies and drafting of the new regulations. Former IMF Managing Director Christine Lagarde explicitly recommended the move to Basel II and III in the Union.

The BCEAO is engaged in a variety of cross-border regulatory networks, including (until recently) the Basel Consultative Group, where the Union was the only representative of low-income countries. Its regulators have developed a special relationship with Moroccan banking authorities, as Moroccan banks have been the leaders in the WAEMU for a few years now. Its supranational position and technical capacity insulates the regulator from political pressures in member countries, providing it with considerable room for manoeuvre.

The adoption of Basel II and III in the WAEMU has not been met with enthusiasm among banks, but neither did they show outright opposition. Most banks are concerned about the brief implementation timeline and human resource constraints. The international banks are more supportive of the reforms as they recognise that the reforms could provide them with a competitive advantage in the regional market.