Author: Toni Weis

Summary

Ethiopia provides an excellent example of the dynamics behind policy-driven divergence. It has chosen not to adopt Basel II or III, and has the least internationalised banking sector among our case countries. Despite significant exposure to the Basel standards through donors and the IMF, banking supervisors at the National Bank of Ethiopia (NBE) have little use for Basel II and III.

Ethiopia’s reluctant approach to the Basel framework does not just stem from the relative isolation of its banking sector or its regulators – it also results from a strong preference for political control over the financial industry, which shows that an interventionist financial policy is one of the more important drivers of divergence. The Ethiopian government seeks to emulate the example of East Asian ‘tiger’ economies, for whom financial repression was a key tool in the pursuit of rapid industrialisation. Thus, all key actors in the country are domestically oriented (Type 1 in our typology). However, as Ethiopia’s domestic banks struggle to sustain transformative growth, pressures for greater financial openness (and, by extension, for increased regulatory convergence) are beginning to mount.

Political economy background

While the Ethiopian economy has been among the fastest growing economies in Africa for the past fifteen years, it remains one of the poorest in the world. Economic development is driven by public investment, and efforts to build a globally competitive, labour-intensive manufacturing sector. The Ethiopian banking industry has remained underdeveloped, closed to foreign competition, and dominated by state-owned institutions. However, private banks have been growing rapidly since they were first licensed in the mid-1990s, and further growth and consolidation is expected in the coming years.

| GDP per capita (current USD) | 767 |

|---|---|

| Bank assets (current USD) | 6.86bn (2008) |

| Bank assets (% of GDP) | 25.33 (2008) |

| Stock market capitalisation (% of GDP) | n/a |

| Credit allocation to private sector (% of GDP) | 17.71 (2008) |

| Credit allocation to government (% of GDP) | 5.99 (2008) |

| Polity IV score (2017) | -3 |

Note: All data is from 2016 unless otherwise indicated

Source: FSI Database, IMF (2018); GDI Database, World Bank (2017), Polity IV (2014)

Basel implementation to date

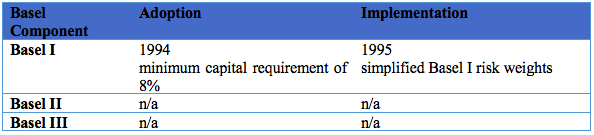

During the 1990s, Ethiopia accepted a structural adjustment programme which required the liberalisation of its banking sector. However, the government refused to adopt the entire programme of liberalisation and prevented the privatisation of state banks and the relaxation of foreign ownership rules. Despite the adoption of the capital adequacy requirements of Basel I and the referencing of the Basel Core Principles as good regulatory practice, Basel II and Basel III are not currently being implemented and there are no plans to introduce them in the near future.

Politics of Basel implementation

Ethiopia is pursuing a development strategy that models itself on the experience of East Asian ‘tiger’ economies, which were characterised by extensive financial repression. Ethiopia seeks to employ similar tools in its effort at industrialisation. Regulators enjoy significant power over a financial sector dominated by state-owned institutions and characterised by restricted foreign ownership rules. In this environment, Ethiopia’s banks have difficulty in obtaining capital to sustain transformative growth and pressure for more financial openness is increasing.

The Ethiopian government’s self-perception as a developmental regime guides its belief in control of financial markets as a tool of industrial policy. Regulators take pride in technical expertise but remain loyal to the government and its policies rather than integrating more fully with international networks and institutions. Domestic commercial banks are the primary beneficiaries of the government’s protectionist policies, and they have little incentive to adopt international standards due to a reluctance to expand abroad. This may shift, however, as domestic banks become more desirous of foreign investment and capital as part of what may lead to a gradual internationalisation of the Ethiopian financial sector.

Given the high degree of policy intervention in the Ethiopian financial system, the Ethiopian central bank is a thoroughly political – rather than politically independent – institution, and this role is enshrined in its governing documents. Furthermore, Ethiopia’s insistence on ‘policy independence’ has made for rocky relationship with the Bretton Woods institutions, and particularly the IMF. There are few indications of outright clientelism between banks and political elites. The relative acquiescence of Ethiopia’s private banks is partially explained by the fact that they are among the main beneficiaries of the NBE’s inward-looking and protectionist policies.

Outside the banking industry, the gradual internationalisation of Ethiopia’s financial sector has begun to manifest itself. The government has made it clear that it does not consider the current level of financial restriction as a goal in itself, but rather as a means to an end, to be phased out over time. The long-term objective of regulators is therefore to converge with global regulatory standards, but at a slower pace and without forfeiting control over the process. It is very much driven by domestic considerations.