Author: Hazel Gray

Summary

Tanzania only finished implementing risk-based supervision in 2009 and opted for selective implementation of Basel II and III standards beginning in 2017, making it a relatively slow and cautious adopter of Basel standards. From 1991 to 2008, Tanzania liberalised its financial sector under influence of the IMF and World Bank, but a significant gap emerged between the formal commitment to adopting Basel standards and the actual pattern of implementation and enforcement. It was only from 2009 onwards that Basel implementation was prioritised due to the appointment of a new internationally oriented Governor at the Bank of Tanzania (BoT) and the influence of EAC commitments to regulatory harmonisation. During this period, the BoT took a tailored approach to Basel adoption, with different regulatory requirements for development banks. Domestic and foreign banks initially showed little interest in rapid adoption but their preferences have shifted due to pressures from parent banks and anti-money laundering concerns.

Political economy background

Until the mid-1980s, Tanzania was a centrally planned economy with extensive restrictions on the private sector and a large proportion of the economy under direct government ownership. From 1986, Tanzania set out on a path towards economic liberalisation and privatisation, under the influence of a series of structural adjustment agreements with the IMF. These changes to economic policy were followed by political reforms that led to the introduction of multiparty elections in 1995. Economic growth has been driven by rising foreign and domestic investment in services and the emerging mining sector, and despite rapid urbanisation and a return to manufacturing growth after a severe downturn, the country remains one of the least industrialised in the world.

| GDP per capita (current USD) | 936 |

|---|---|

| Bank assets (current USD) | 8.9bn |

| Bank assets (% of GDP) | 18.8 |

| Stock market capitalisation (% of GDP) | Data not available |

| Credit allocation to private sector (% of GDP) | 14.4 |

| Credit allocation to government (% of GDP) | 5.3 |

| Polity IV score (2017) | 3 |

Note: All data is from 2016 unless otherwise indicated

Source: FSI Database, IMF (2018); GDI Database, World Bank (2017a); Polity IV (2014)

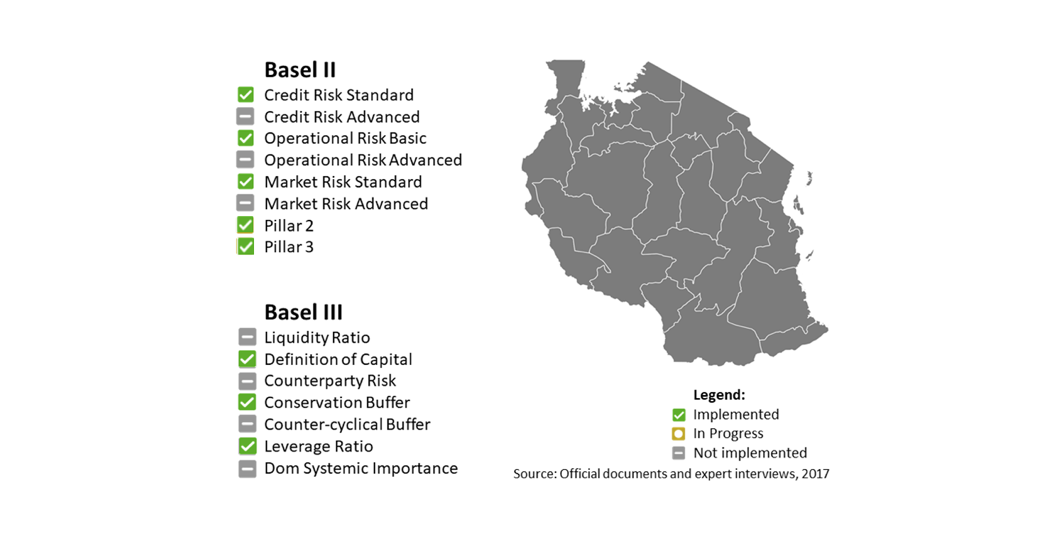

Basel implementation to date

Since the liberalisation of the banking sector in the early 1990s, Tanzania has formally been committed to implementing Basel standards. The 1991 Banking and Financial Institutions Act contained a simplified version of Basel I. The formal commitment to implementing Basel standards continued during the 1990s and early 2000s but implementation was slow and enforcement was weak. After 2009, the pace of Basel implementation and enforcement changed as Tanzania decided to adopt elements of both Basel II and III and push forward with implementation by 2018. While the larger and foreign-owned banks were already prepared to comply with these standards, many of the smaller banks have struggled to prepare for the new capital requirements.

Politics of Basel implementation

The initial impetus for Basel adoption in Tanzania came from the IMF and World Bank. They played a significant role in shaping Tanzania’s approach to banking supervision in the 1980s and 1990s through loan conditionality and technical assistance. However, the formal commitment to adopt these standards did not lead to an effective implementation. This was partly a result of lack of interest in faster implementation on the part of commercial banks and powerful politicians whose interests were not served by stronger implementation.

Despite the dominance of foreign banks, the banking sector was domestically oriented and did not need to signal creditworthiness to international investors, nor were the domestic banks interested in entering foreign markets.

The pace of Basel implementation and enforcement increased markedly after 2009. Key drivers were a change in the top leadership at the Central Bank and the emergence of a stronger agenda on harmonisation of banking regulation across the region from the East African Community. Members of the Central Bank and the Ministry of Finance discussed Basel II and III implementation as part of a regional road map to harmonise banking regulation in the Monetary Affairs Committee of the EAC.

Large commercial banks also started to push for faster Basel II and III adoption due to pressures from parent banks, the blacklisting of Tanzania by the Financial Action Task Force due to Anti-money laundering concerns, and competitive pressures from smaller domestic banks.

In the 2010s, there was a return to the idea that the state should take a more active role in development and politicians in Tanzania endorsed a more interventionist approach to the financial system, including a renewed emphasis on policy lending and financial inclusion. This change was reflected in a more tailored approach to Basel implementation, with different regulatory requirements for development banks.